Tel:

Tel: Email:

Email: Website:

Website: Address:

Address: Current position:Xiongda International Logistics Company - Others - Information Centers - How is the international logistics company responsible for customs declaration and tax refund? - Xiongda International Logistics

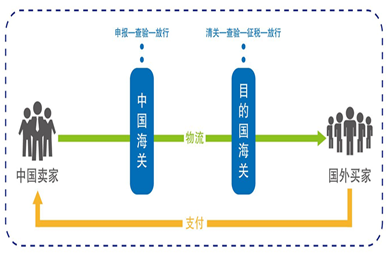

Current position:Xiongda International Logistics Company - Others - Information Centers - How is the international logistics company responsible for customs declaration and tax refund? - Xiongda International LogisticsIn fact, for the export goods of international logistics companies, such as clothing products, whether international logistics companies can include customs declaration and tax refund operations, many trade and factories and enterprises know that international logistics companies may only be a process of transportation, from the beginning to the destination, then very much. Many companies advertise that double-clearance tax is what happens? Let's take a look at the answers to the following two questions

In fact, the international logistics company is only a transportation process. This process is the freight generated by the transportation from the departure to the destination. Then Xiongda International Logistics Company can act as an agent for customs declaration and charge a certain fee. That is to say, the international logistics company of "customs declaration" of this product is an international logistics company. It can be done.

Regarding tax rebate, in fact, international logistics companies can not do it, because tax rebate involves qualification issues, need to invoice to report, according to the value of goods, the standard of tax rebate is different, it is suggested to find a professional customs declaration rebate company to do it will save effort.